As October begins, many Australian SMEs find themselves caught between chasing unsatisfied annual goals and preparing for a fresh start in 2026. Q4 often becomes a scramble — but it doesn’t have to be. With clarity, focus, and data-driven discipline, you can finish the year strong and set the momentum for the next.

In fact, recent SME data in Australia suggests the challenges are real: cash flow management remains the top concern for many business owners, and economic conditions are tightening. According to the State of Australian SME Report (August 2025), cash flow is still the primary operational worry for SMEs, and turnover growth is uneven across sectors. Meanwhile, the Reserve Bank’s Small Business Bulletin highlights that demand growth has slowed and input costs remain elevated — putting further pressure on profit margins.

Against this backdrop, a thoughtful Q4 plan isn’t an optional luxury — it’s essential.

Why Q4 Strategy is Non-Negotiable

1. The final quarter often defines your annual narrative

Business leaders often compare it to a relay race: if your last leg is weak, it can undo earlier gains. Organisations that maintain disciplined goal tracking and adaptive strategies in Q4 are much better positioned to hit targets and carry momentum into the new year.

2. Financial, operational and human pressures intensify

- Cash buffers are being drawn down. Many SMEs built reserves during the pandemic, but those are shrinking under persistent cost pressures and slower revenues.

- Credit and financing constraints tighten. Lending conditions are tighter, and many small businesses find credit access restrictive.

- Productivity gaps widen. Recent commentary notes that Australian SMEs lag about 50% behind large firms in productivity due to slower tech adoption, regulatory burdens and skills constraints.

- Client concentration risk looms. For many SMEs, losing one major client could be catastrophic. In fact, a ScotPac SME Growth Index report found 29% of SMEs claim they’d be at risk of insolvency if one major client or supplier exited.

Given these pressures, Q4 planning must be more than wishful thinking — it must be deliberated, executable, measurable, and robust to be able to combat external volatility.

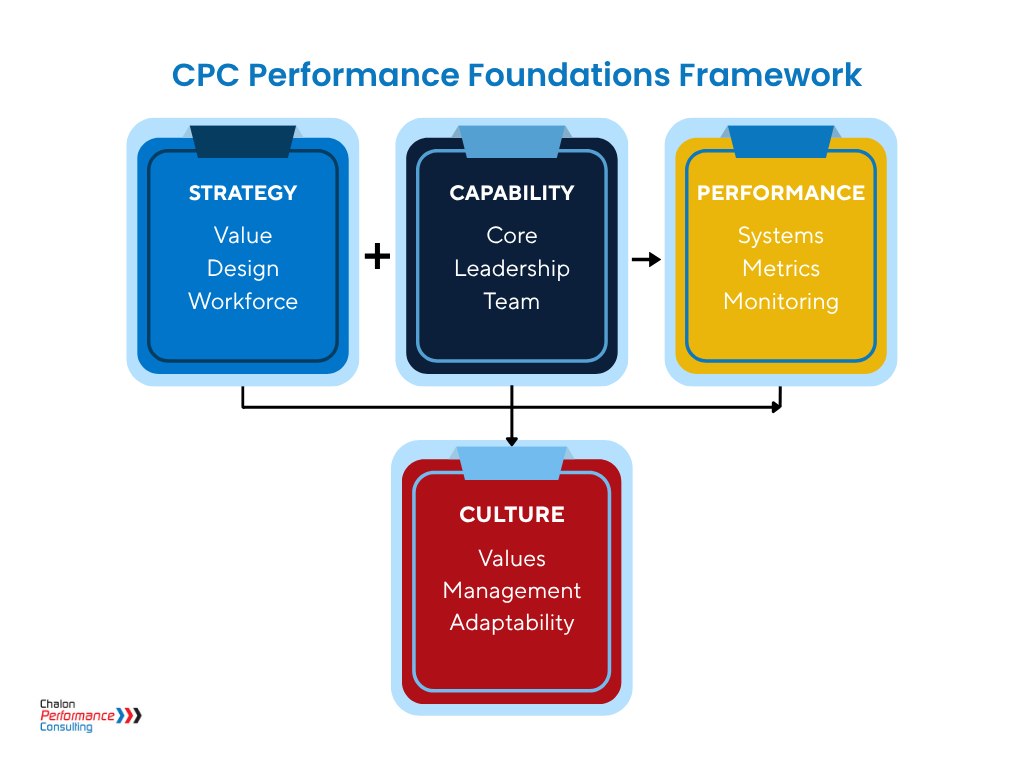

Four Pillars of Effective Q4 Planning

Here’s a strategic framework you can adopt immediately for better outcomes.

Pillar 1: Recalibrate Goals & Prioritize Ruthlessly

Begin by revisiting your annual goals. Ask:

- Which targets are still achievable in three months?

- What low-impact initiatives should be paused or shelved?

- What must be completed to keep 2026 grounded in success?

Use SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) to refine Q4 goals. For example, instead of “increase sales,” aim for “grow Q4 gross margin by 7% versus Q3 through upsell campaigns.”

Pillar 2: Sharpen Cash Flow & Expense Discipline

Cash is king this quarter. Your planning must include:

- Receivables acceleration: offer early payment discounts or enforce stricter terms.

- Expense trimming: review all discretionary spend (marketing, travel, subscriptions).

- Supplier renegotiation: explore better terms, bulk discounts or extended payment windows.

- Forecast scenarios: run worst, base and best-case cash flow models weekly — not monthly.

Bentleys emphasises that for Australian businesses, metrics such as liquidity ratios, cash flow forecasting and expense management are core financial levers to monitor.

Pillar 3: Align Your People to Critical Priorities

Your plan lives or dies in execution — which depends on clear alignment:

- Communicate the “why” behind Q4 objectives (e.g. safeguarding jobs, enabling investment in 2026).

- Cascaded ownership: ensure each team member knows which Q4 objective they own.

- Frequent check-ins: use weekly or biweekly cadence to monitor progress, surface challenges, and adapt.

- Recognition & morale: celebrate incremental wins to keep momentum (especially through Christmas fatigue).

Pillar 4: Build Adaptive Mechanisms

Given uncertainty in demand and costs, your plan must allow flexibility and contingency:

- Trigger points and decision gates: define thresholds (e.g. if sales drop by X%, pause campaigns).

- Buffer reserves: reserve a small portion of budget/effort for strategic pivots.

- Rapid review loops: treat Q4 like a series of mini sprints rather than a monolithic block.

A Hypothetical Q4 Planning Story

Consider an Adelaide-based professional services SME. At the end of Q3, they had two major client proposals outstanding. Their original plan assumed both would convert, but by early October they only secured one. Their Q4 pivot involved:

- Redirecting marketing spend into email campaigns for upsells to existing clients.

- Cutting down lower-margin services and reallocating consulting hours to high-profit offerings.

- Running weekly cash flow reviews to reforecast and manage the headroom.

- Empowering account managers to negotiate upsell deals with clients earlier than expected.

As a result, instead of falling short by 15%, they closed the year within 5% of target and carried forward momentum into 2026 planning sessions.

That pivot was only possible because they set up their Q4 plan with built-in adaptability — and refused to overcommit to assumptions.

Q4 Planning Checklist (For Execution)

| Focus Area | Key Actions | Frequency |

| Strategy clarity | Refine to 3–5 high-impact Q4 objectives | Once, start of Q4 |

| Cash & costs | Do real-time forecasting, trim spend, renegotiate suppliers | Weekly |

| Team alignment | Communicate priorities, assign clear ownership | Biweekly or weekly |

| Monitoring & agility | Use dashboards, compare actual vs plan, trigger pivots | Weekly or twice weekly |

| Morale & recognition | Celebrate small wins, encourage team input | Monthly or ad hoc |

Looking Beyond Q4: Set the Stage for 2026

Good Q4 planning doesn’t end in December. Use insights and learning from your Q4 execution to feed into your full-year 2026 strategy:

- What data and customer trends emerged unexpectedly?

- Which pivots worked — and which didn’t?

- Where did capacity constraints show up?

- What new initiatives should begin early in Q1?

Link Q1 2026 plans to momentum, not a cold start. And because your 2025 plan has already been stress-tested, your 2026 execution is more likely to succeed.

Q4 planning is messy, high-stakes work — but you don’t need to do it alone. At ChalonPC, we specialise in Strategy Development and Performance Management for SMEs and growth organisations. Our approach helps you move from aspiration to execution without overwhelm.

Ready to map your best Q4 yet? Explore our Strategy Development service or may I propose a free roadmap session to help you lock in actionable steps.